Perils of undervaluation of listed companies

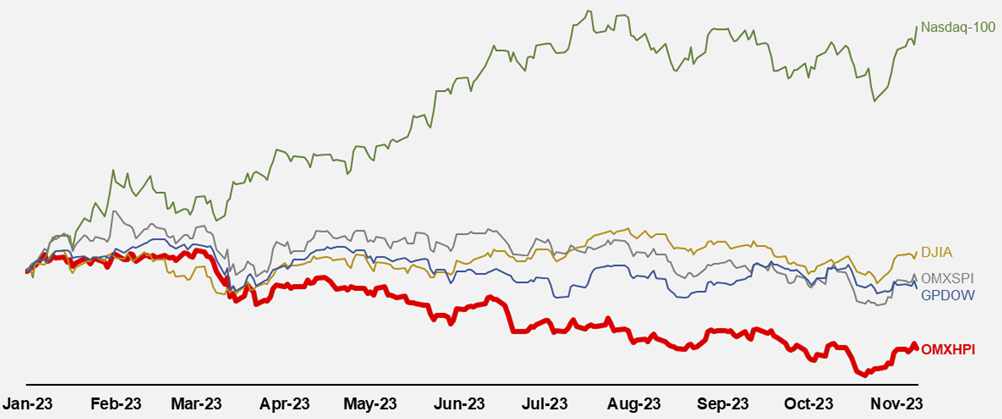

OMX Helsinki has been one of the worst performing stock market indices during 2023 (OMXHPI -9.64%) underperforming most of the other key indices followed by investors (for instance, DJIA +6.05%, NASDAQ100 +46.50%, OMXSPI +5.79% YTD and GBDOW +0.25%). What are the implications for NASDAQ Helsinki listed companies and their shareholders?

A low market value can have a significant impact on a company’s strategy and operations. Raising new capital from the market becomes more challenging, and the availability of financing may decrease, which may lead to a reassessment of previously made investment plans. A sense of uncertainty and pessimism may prevail, and as the situation persists, difficulties in motivating and retaining key employees become more pronounced.

Low valuations can make companies vulnerable to activist investors who may seek to influence the company’s strategy, management changes, or asset divestitures to unlock value for shareholders.

A low market valuation also makes the company a more attractive target for potential acquirers, particularly as it may be seen as undervalued compared to its peers.

In finance and investing, intrinsic value refers to the true, underlying value of an asset, such as a stock, bond, or real estate, based on its fundamentals. It contrasts with the market price, which is determined by the supply and demand dynamics in the market.

According to the Securities Market Act, a mandatory takeover bid must offer a fair price, with the fair price based on the volume-weighted average prices of the securities in question traded in public trading during the six months preceding the obligation to make the bid.

Six months is a very short period in the business world. The past year and ongoing market decline weigh on investors’ minds, and many professional investors may be tempted to improve their dismal year-end performance by accepting a takeover bid with at least some premium.

When evaluating a takeover bid, the premiums paid in the market are compared, with excessive attention sometimes focused on the average and median. The average premium for an undervalued stock alone does not make a takeover bid attractive. The offer consideration, including the premium, can either be a good deal or not when compared to the intrinsic value of the company.

On the other hand, McAfee’s cash offer for Stonesoft, with a premium of 128% compared to the closing price of the stock on the trading day preceding the announcement of the bid, killed quite a few good deals as anchor investors demanded too much when the premium paid for Stonesoft became the new target level.

The company’s board and executive management should have the best knowledge of the company’s situation and prospects but may not necessarily a real-time understanding of the stock’s intrinsic value. This is a problem, especially in a changing business environment and market situation. From the shareholder’s perspective, it may also be challenging to assess the attractiveness of a takeover bid. For this reason, the Takeover Code recommends that the target company’s board prepares a reasoned appraisal of the public takeover bid and the bidder’s plans based on careful preparation. The board, in its statement, should recommend either accepting or rejecting the bid.

Need for defense

Defense mechanisms in takeovers refer to strategies and tactics that a target company (the company being acquired or taken over) can employ to fend off or resist an unsolicited acquisition attempt by another company, known as the acquirer or bidder or a short-term focused activist investor. These defense strategies are deployed to achieve several objectives:

Preservation of Shareholder Value: One of the primary aims of takeover defenses is to safeguard the value of the target company for its shareholders. When a hostile takeover occurs, the acquirer may be attempting to acquire the company at a price that does not fully reflect its intrinsic value. Defense mechanisms can potentially result in a higher acquisition price or better terms for shareholders.

Negotiating a Better Deal: By resisting a hostile takeover, the target company’s management can use defense mechanisms as leverage to negotiate a more favorable deal with the acquirer. This may involve increasing the acquisition price, improving the terms, or obtaining other concessions that benefit shareholders.

Preventing Hostile Takeover: The primary objective of many takeover defenses is to deter or thwart the hostile acquirer from gaining control of the target company altogether. This is often achieved by making the takeover more costly, complex, or unattractive, which can discourage the acquirer from pursuing the acquisition.

Protecting Jobs and Culture: Target companies often have concerns about how a hostile acquirer might affect the company’s workforce and corporate culture. Defense mechanisms can be used to maintain the existing management team and company culture, which may be seen as valuable assets.

Maintaining Strategic Independence: Target companies may resist hostile takeovers to maintain their strategic independence and execute their business plans without interference from the acquirer. They may believe that they are better off remaining independent rather than being absorbed by the acquirer.

Avoiding Fire Sale: In some cases, a hostile acquirer may intend to break up the target company or sell its assets at a discount, potentially harming shareholders. Takeover defenses can be employed to prevent a “fire sale” scenario and ensure that assets are sold at a fair market value.

Time for Evaluation: Defense mechanisms can provide the target company’s board and shareholders with additional time to evaluate the proposed acquisition, assess its potential impact, and consider alternative options. This allows for a more informed decision.

Protecting Against Opportunistic Bidders: Some hostile takeovers may be initiated by opportunistic bidders looking to capitalize on a temporary decline in the target’s stock price. Defense mechanisms can discourage such opportunistic bids and protect shareholders from selling their shares at an undervalued price.

Be prepared

A defense manual is a document or set of guidelines created by financial and legal advisors in close collaboration with a target company’s management to outline the company’s strategy and actions to be taken in the event of a hostile or unsolicited acquisition attempt.

The purpose of a defense manual is to provide the company’s Board of Directors, executives, and relevant stakeholders with a clear plan on how to respond to a hostile takeover bid. It typically includes various strategies and tactics that the company can employ to protect its interests and maximize shareholder value.

A defense manual typically includes an overview of the various stages and legal requirements involved in a takeover process, including disclosure and regulatory obligations, a detailed explanation of the legal and regulatory aspects related to takeovers, guidelines for communications strategy, information on defensive measures that the company can employ, strategies for engaging with and mobilizing shareholders in support of the company’s board and management, clarification of the roles and responsibilities of the board of directors and any special committees formed to address the takeover situation, detailed financial analysis, including the company’s valuation, to support the board’s decision-making process and to demonstrate the fairness of any counteroffers or defensive measures, a list of external advisors, including legal, financial, and public relations firms, who can assist the company in navigating the takeover process and recommendations on how to engage with the hostile acquirer and potentially negotiate a better deal on behalf of the shareholders. This might also include strategies for seeking out friendly acquirers (white knights) as alternatives.

Competing public offers have been relatively rare in Finland, but they have become more common, and shareholders have benefited from this trend (check for instance, public offers for Caverion and Uponor). Acquirors have taken the changed situation into account by being flexible with the terms. A typical and crucial condition for the completion of an offer has been reaching a 90% ownership threshold, but, for instance, in the offer made for Ahlstrom, the condition was 75%, and in Bain Capital’s offer for Caverion, it was 2/3. In a public offer situation, time is of the essence, and if interest in the company has not been previously assessed, it can be challenging to jump on the quickly moving train, especially for those who are not already familiar with the company…

It’s important to note that defense manuals are typically created in advance, during periods of strategic planning, and are kept confidential. They are used as a reference guide for the company’s leadership and legal teams in the event of a hostile takeover attempt. The contents of a defense manual are tailored to the specific circumstances and needs of the target company, and they need regular updates.

Conclusions

If the target company’s board is contacted for the purpose of a takeover offer, and the board considers the contact to be serious, the board must assess, in accordance with the Takeover Code’s recommendation, what actions may be required to secure the interests of shareholders and the company. The Takeover Code also obliges the board to actively work towards achieving the best outcome for shareholders.

Time moves quickly after the initial contact. Thorough preparation enables better-informed decisions and provides additional time to consider alternative options.

After experiencing a significant decline in the stock price, a company’s board should carefully assess the situation and consider seeking expert advice to develop a comprehensive defense strategy.

About the writer:

Jussi Majamaa has extensive experience in providing financial advisory services for acquirors and targets in public offers, co-written several defense manuals and companies represented by him have provided fairness opinions for several to boards of public companies concerning a public offer.

Next steps

Perhaps you would like to discuss more and see how we could help your business. Please don’t hesitate, let us contact the way best suits you.